You may (or may not!) be aware that we recently undertook a collaborative study with Stephen Waddington. Through interviews with communications leaders across the US and Europe, we devised the Foresight framework. This framework is fast becoming an essential tool for communications professionals dealing with polarizing issues.

While it’s a framework specifically designed for politically polarizing scenarios, it’s just as effective for mitigating almost any known issue. So, today, we’re going to delve a little deeper into different parts of the framework, and illustrate them with real-world data.

This blog will introduce the first two of six key components in our framework: aligning on company priorities and benchmarking them. We’ll also highlight one of the benefits of that work — spotting the types of changes in interest that are worth monitoring within those two stages.

What is company priority alignment and benchmarking?

Simply put, this is an ongoing awareness of the internal and external challenges your company could face. It identifies how a mix of company priorities dovetail and interact with the prevailing political, economic, and social environment at any given time.

These challenges can be global or local, depending on the team’s focus, and should be reassessed periodically as both the company and the landscape evolve.

There are endless ways to approach this. That said, a non-exhaustive list might include an ongoing awareness of:

- Your own brand and its positioning

- Your key competitors

- Any topics you’re keen to address or conversations you might (inadvertently) be drawn into

As for what some real-world examples might look like, consider the following scenarios:

- A tech giant might keep track of competitors, AI advancements, and data privacy.

- An FMCG brand could measure its own brand alongside plastic waste and inflation.

- Larger companies may also track political events like boycotts, strikes, elections, and maybe even public interest trends.

While we illustrate the public and media interest in some of these topics further below, there are two factors you should consider when implementing priority alignment and benchmarking:

- Make it relevant: Be realistic about what matters to your brand. Remember, there’s a lot of noise, and not everything actually matters or requires a response. Defining what’s relevant is key.

- Make it flexible: Update your metrics in tandem with your business goals. If your comms measurement doesn’t align with the business side, you’re in danger of creating a disconnect.

Charting change in interest

Once you know what “normal” looks like for your company, and/or your topics of interest, you can use that data to benchmark against others and identify the thresholds of change. Ultimately, the real value of benchmarks lies not in their static levels, but in how the data fluctuates over time compared to that baseline

Here are just a few examples of changes that might spark the interest of a typical comms team.

Change in brand interest

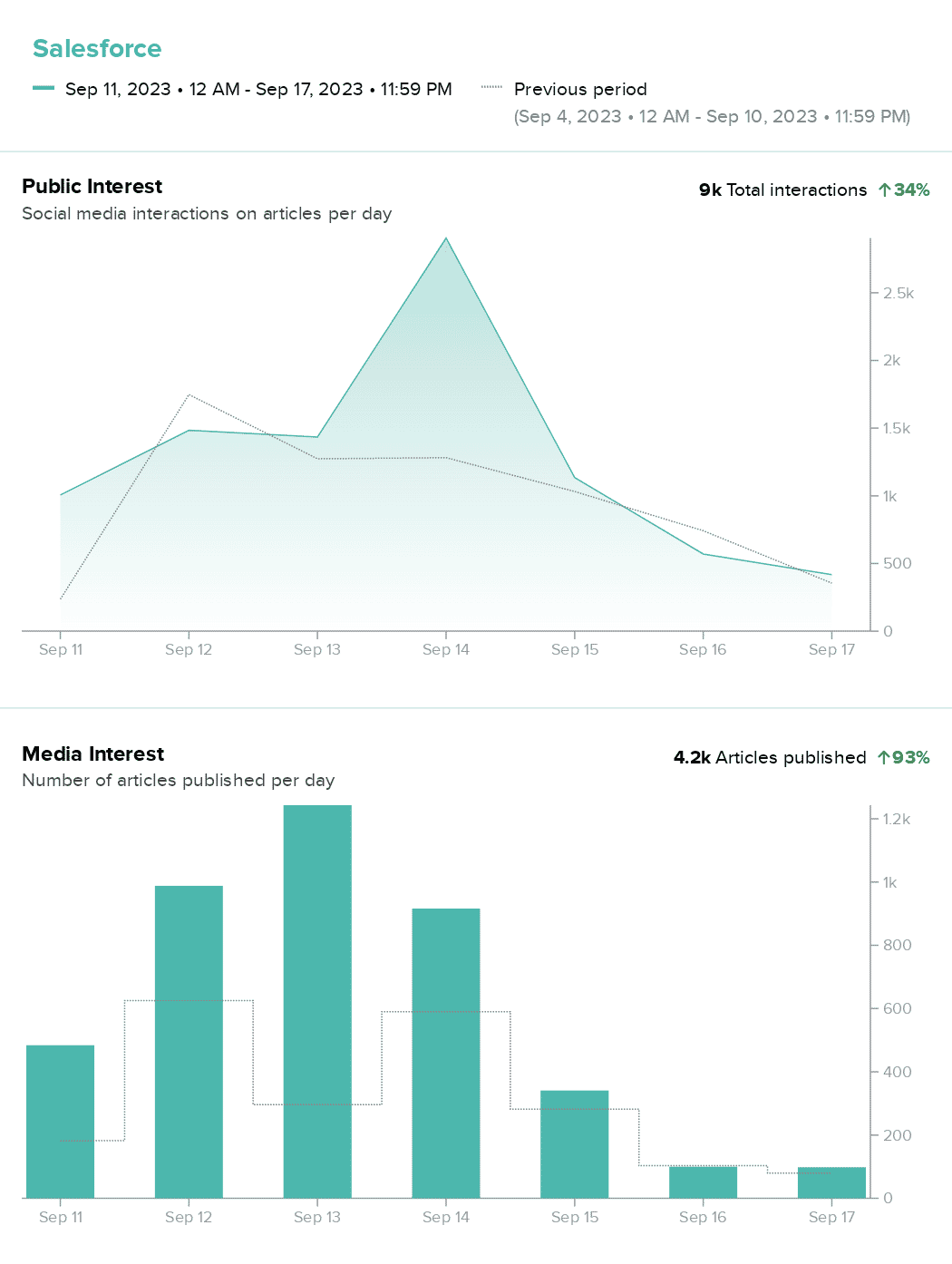

Any sudden movement in brand interest is always of note and requires investigation as to the cause. This could be due to a known event such as a product launch, a public-facing event, or financial results, in which case it can be reported on and measured as part of KPIs.

For instance, the Salesforce data below highlights a noticeable increase in the brand’s media and public interest compared to the previous week, driven by the Dreamforce event in San Francisco.

Change in interest for pre-identified topics

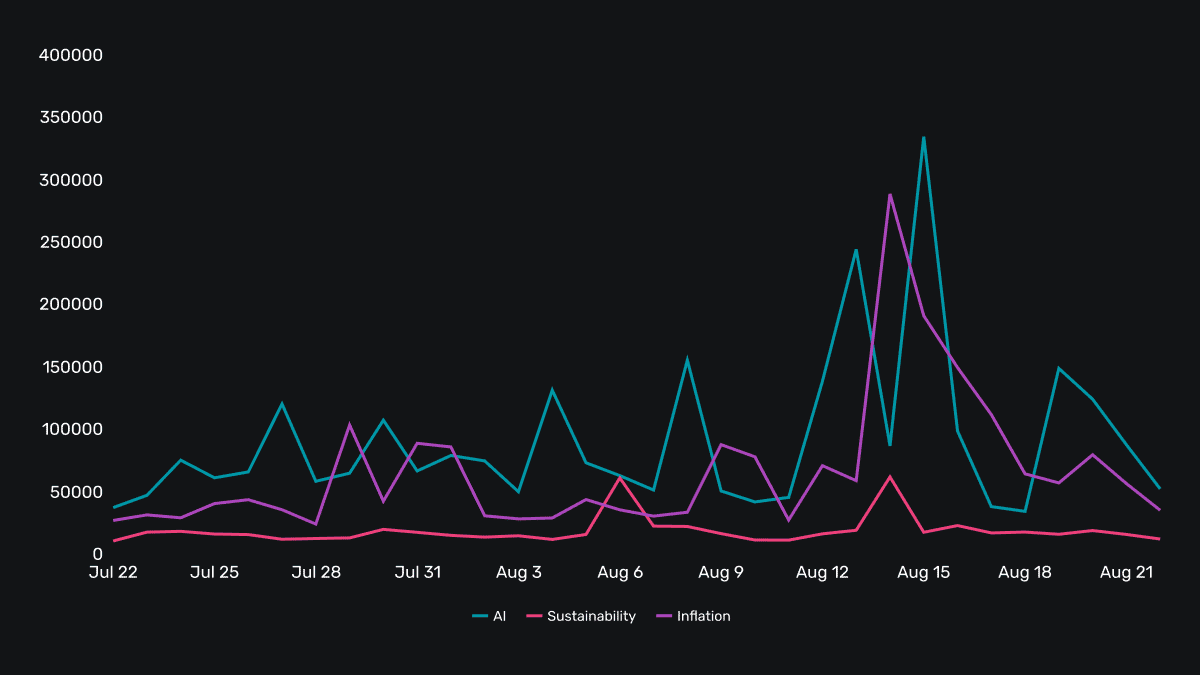

Aside from brand mentions specifically, topics can be tracked in a similar way. For instance, inflation is currently top of mind for the public and therefore likely to be of interest to many brands.

Interest in the topic of inflation has increased significantly recently due to its relevance in the election. The graph alongside it shows the plethora of brands that have also been mentioned.

If your brand is likely to be mentioned in discussions about a particular topic, it’s important to understand the media coverage surrounding it. This helps you identify where your brand is covered – while seizing any potential opportunities to enhance your brand’s presence.

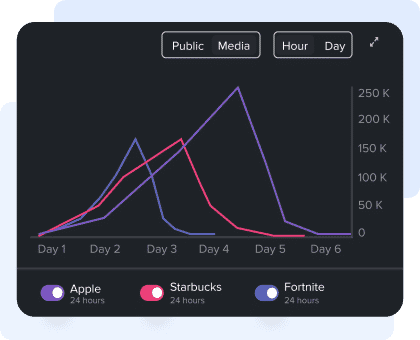

Brand mention alongside an issue

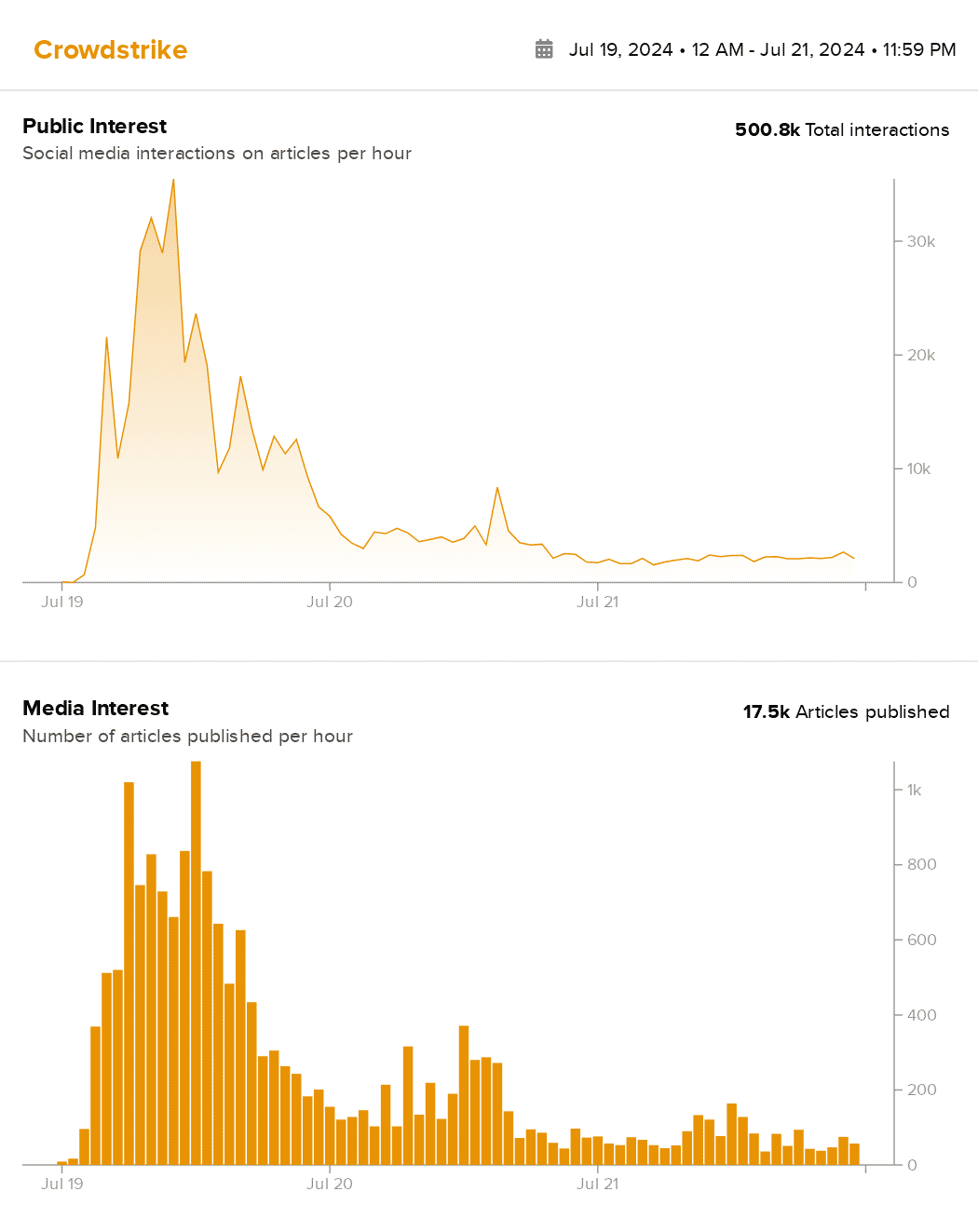

Sometimes, bad things happen. As such, it’s feasible for any brand to be pulled into a negative narrative. When this happens, it’s crucial to understand and assess the situation as soon as coverage begins. Only then can you begin to strategize. Armed with this data, you can see if a response from the comms team is needed, and what kind of response that might be.

Key Takeaway

There are, of course, other examples of queries you might want to measure, but monitoring the changes in interest – be it brand interest, changes in interest for pre-identified topics, or brand mentions alongside an issue – are some of the must-haves across any effective comms team. They can be built on and refined as needed.

In our next installment of this series, we’ll look at how these changes in interest and benchmarks can be spun up into alerts. We’ll also outline how digests can keep you abreast of any situation if there are no dramatic changes.

If you’d like to discuss how the foresight framework can be applied to your brand’s comms challenges, you can reach out to us here.