We recently published our first brands report, which looked back at articles about some of the top brands across three different industries to draw conclusions about what resonated with the public and media in earned media coverage.

Those sectors were tech, food & bev, and auto, and we looked at a handful of brands or brand families in each. Here’s some of what we learned, as well as a few tidbits that we couldn’t fit into the full report.

Tech coverage takeaways

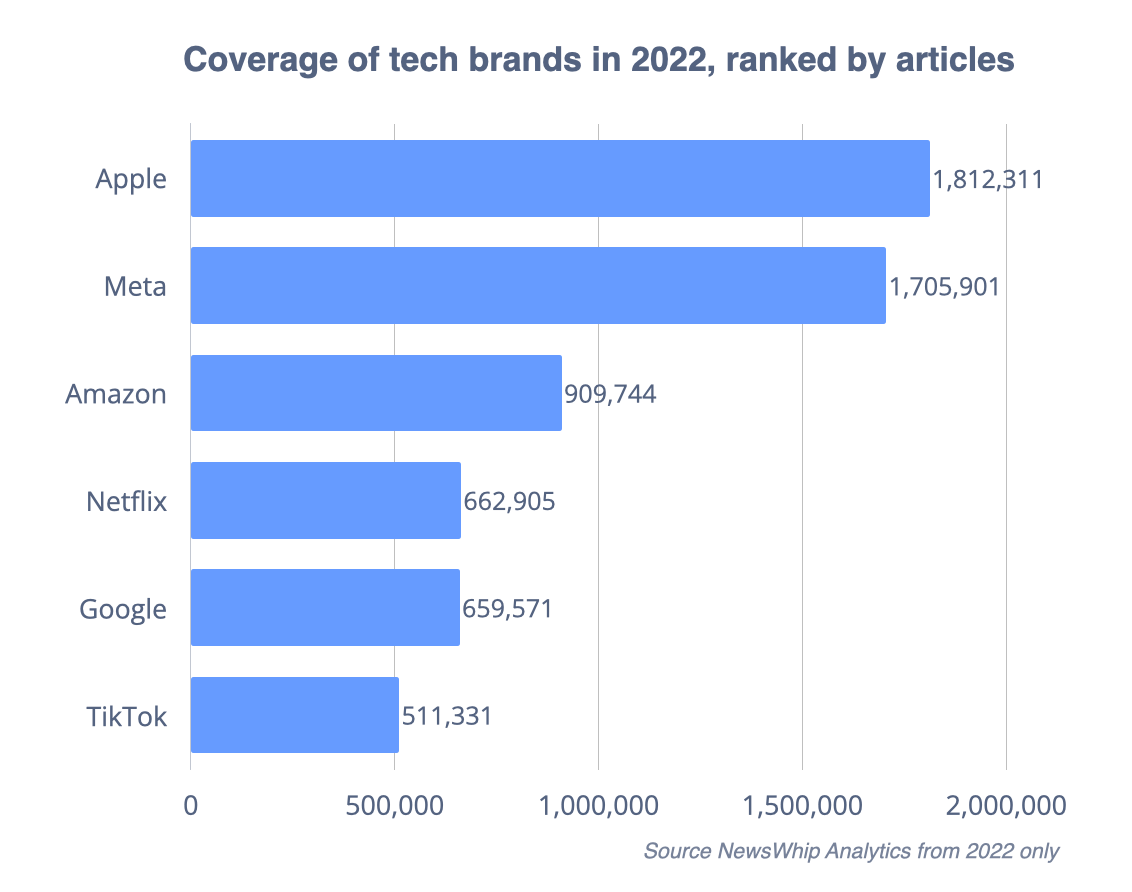

Tech was by far the most written-about sector of the three we looked at, thanks to massive coverage of the likes of Facebook, Samsung, Tesla.

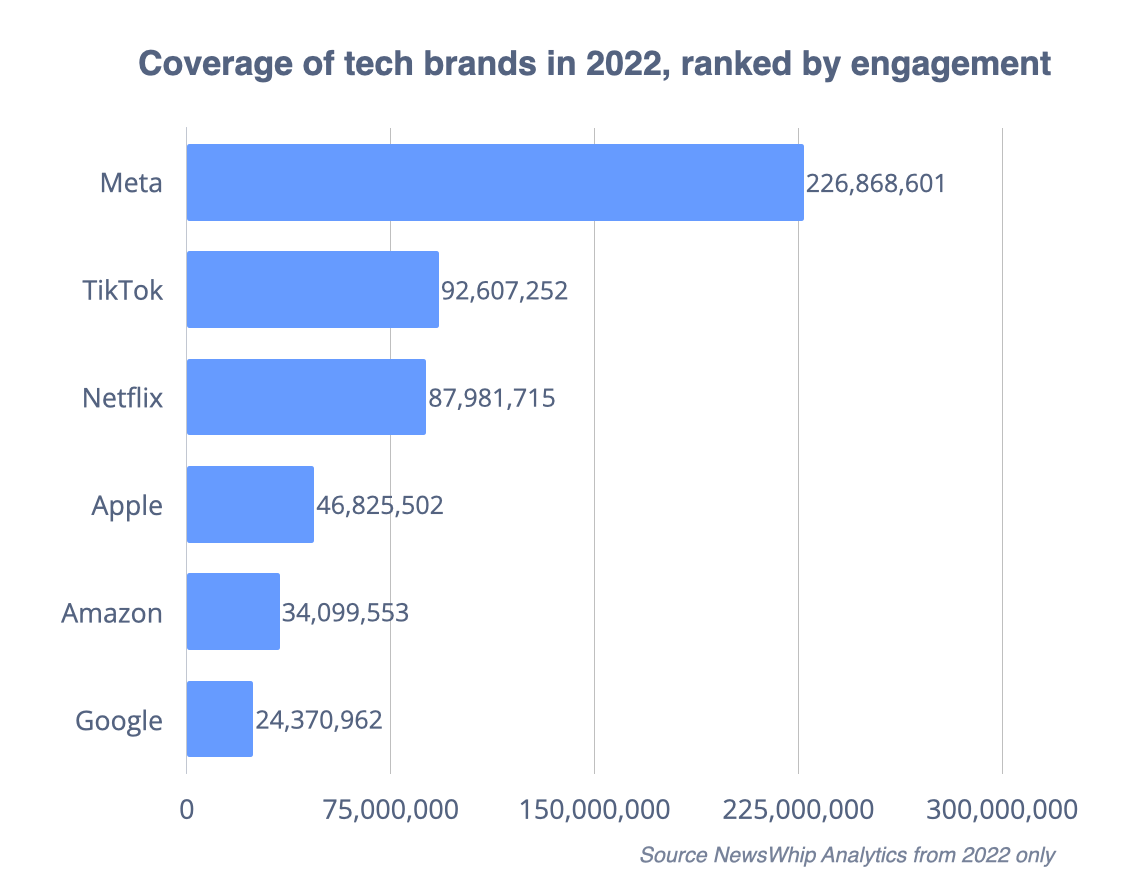

Of these, Meta saw the most engagement by a significant margin, with more than double that of its closest competitors for engagement — TikTok and Netflix.

Much of this engagement across the entire group of companies we looked at was driven by the struggles tech companies faced in the stock market early in 2022. This contributed to a jump in both media and public interest as many engaged in speculation about what this meant for the future of the companies and the market at large.

TikTok saw a lot of its coverage coming from the platform emerging as a ‘town square’ alternative to Twitter, where people voiced opinions about the events of the day. This was evidenced principally by the Johnny Depp & Amber Heard trial but was also true of other events in 2022, and we can expect that to continue into 2023.

The media coverage was not as dramatically weighted as the engagement was, with Meta having a similar level of coverage to Apple in 2022. TikTok is perhaps the most notable here, as it had the least amount of coverage overall by a distance, but was among the top three of most engaged brands, showing it is a rising star even among mainstream readers.

Food & beverage coverage

Something we already knew but that was reinforced in this report was that recipes are a huge driver of engagement in the food and beverage space, and much of that engagement comes from niche blogs and smaller outlets.

These blogs, while often recipe-focused, do frequently mention specific brands as part of those recipes, so they can be an important source of coverage even though they might not be top-tier media.

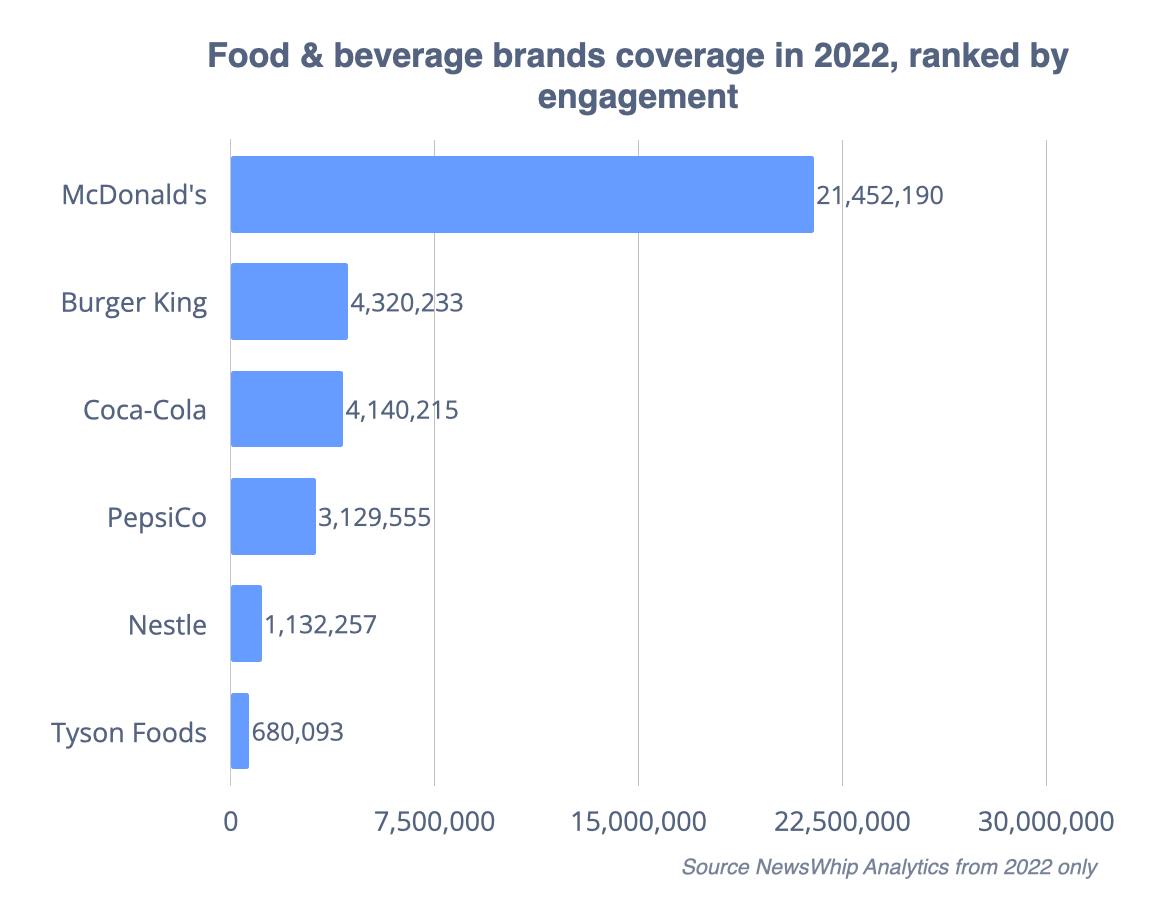

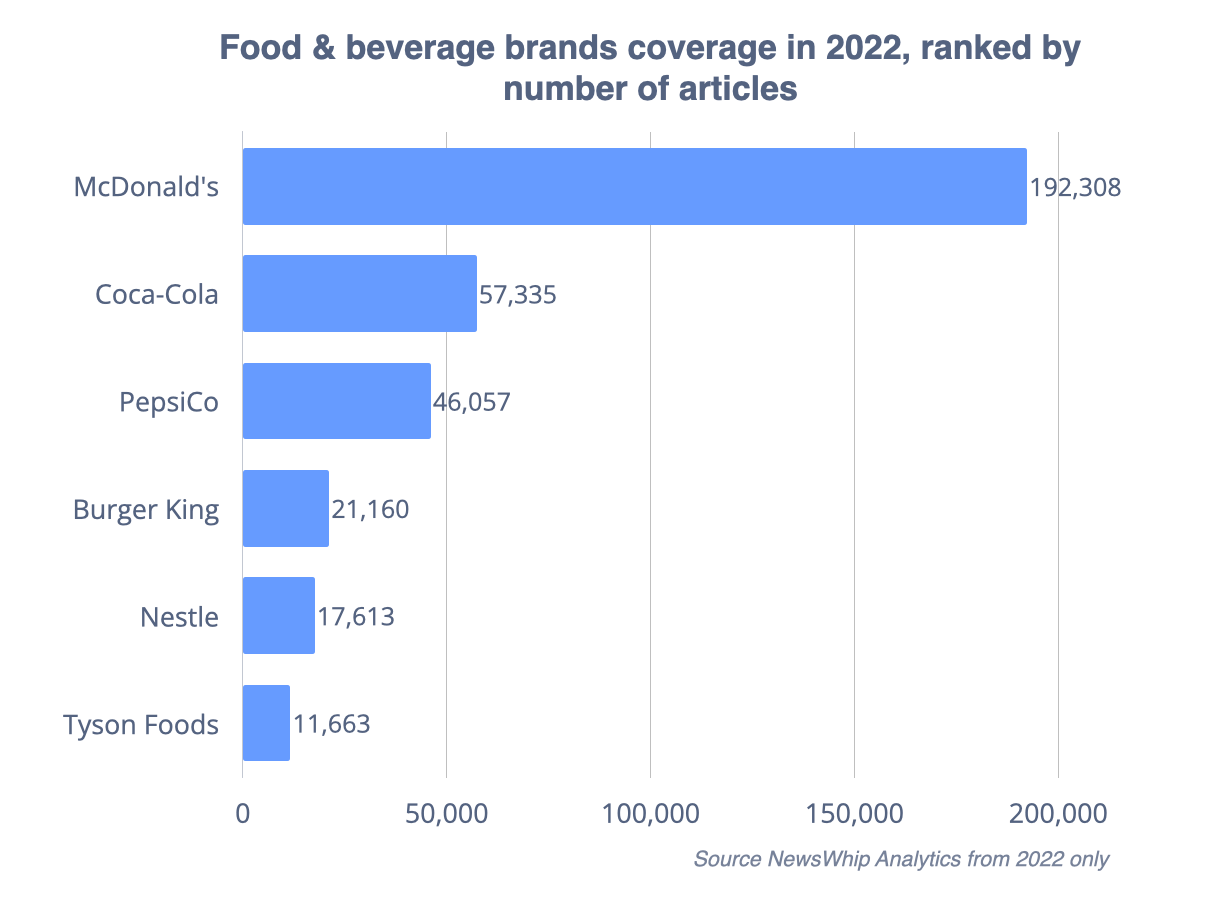

When it came to brand coverage, there was really only one winner, with McDonald’s seeing an outsized amount of attention and more engagement than the other five brands we looked at combined.

The 21 million engagements the brand received came from a variety of topics, from menu decisions to Russian operations, with several individual stories receiving hundreds of thousands of engagements.

Due to selling relatively inexpensive and easy-to-purchase physical goods, food & beverage brands were perhaps most prone to criticism over continued business dealings with Russia after the invasion of Ukraine of the sectors we looked at, though most were eventually praised for ceasing operations even if they did initially receive criticism.

McDonald’s also dominated when it came to media interest, but again the effect was less dramatic than it was for public interest.

Automotive takeaways

Automotive brands were an interesting case study in coverage as individual brands were often dragged into reporting where the brand was mentioned tangentially, as accidents and the trucker convoy in Canada dominated headlines in 2022.

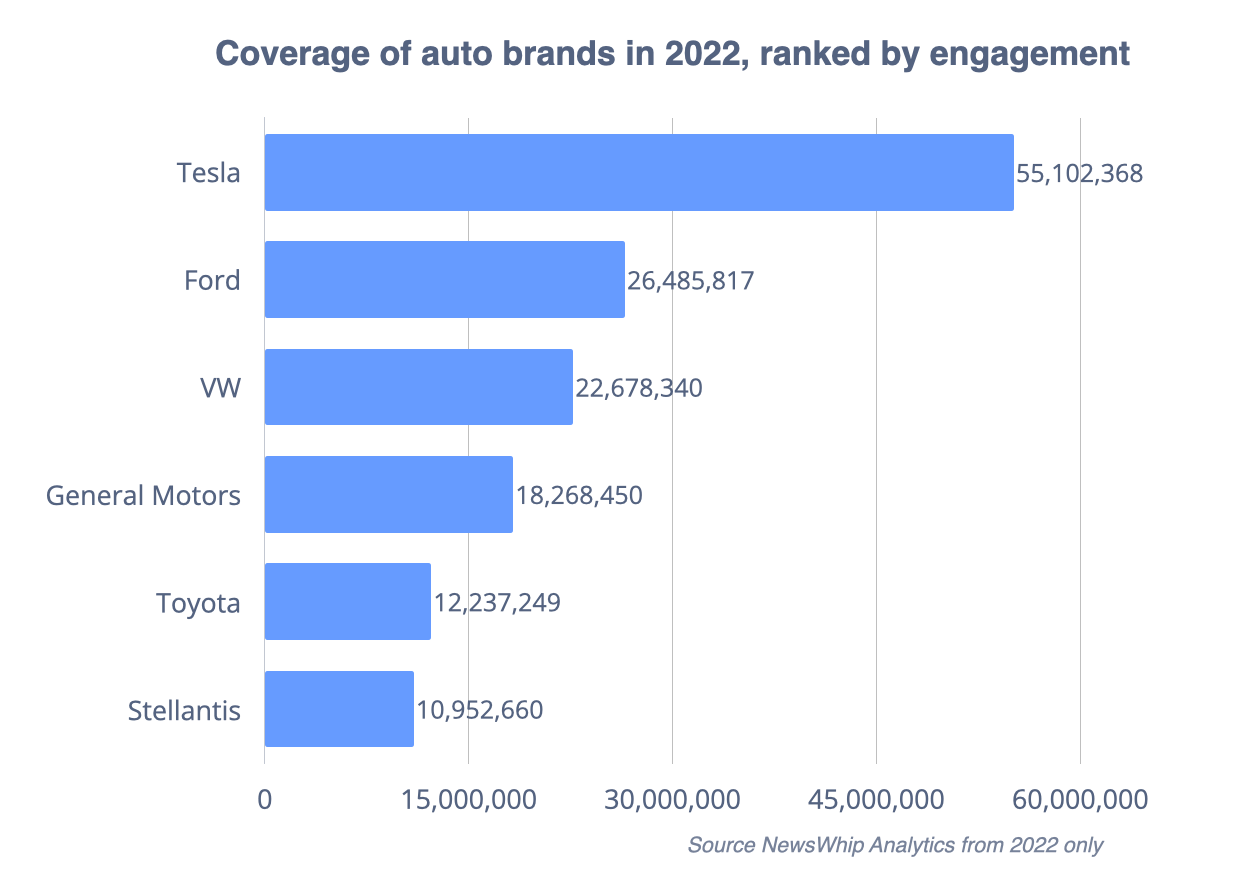

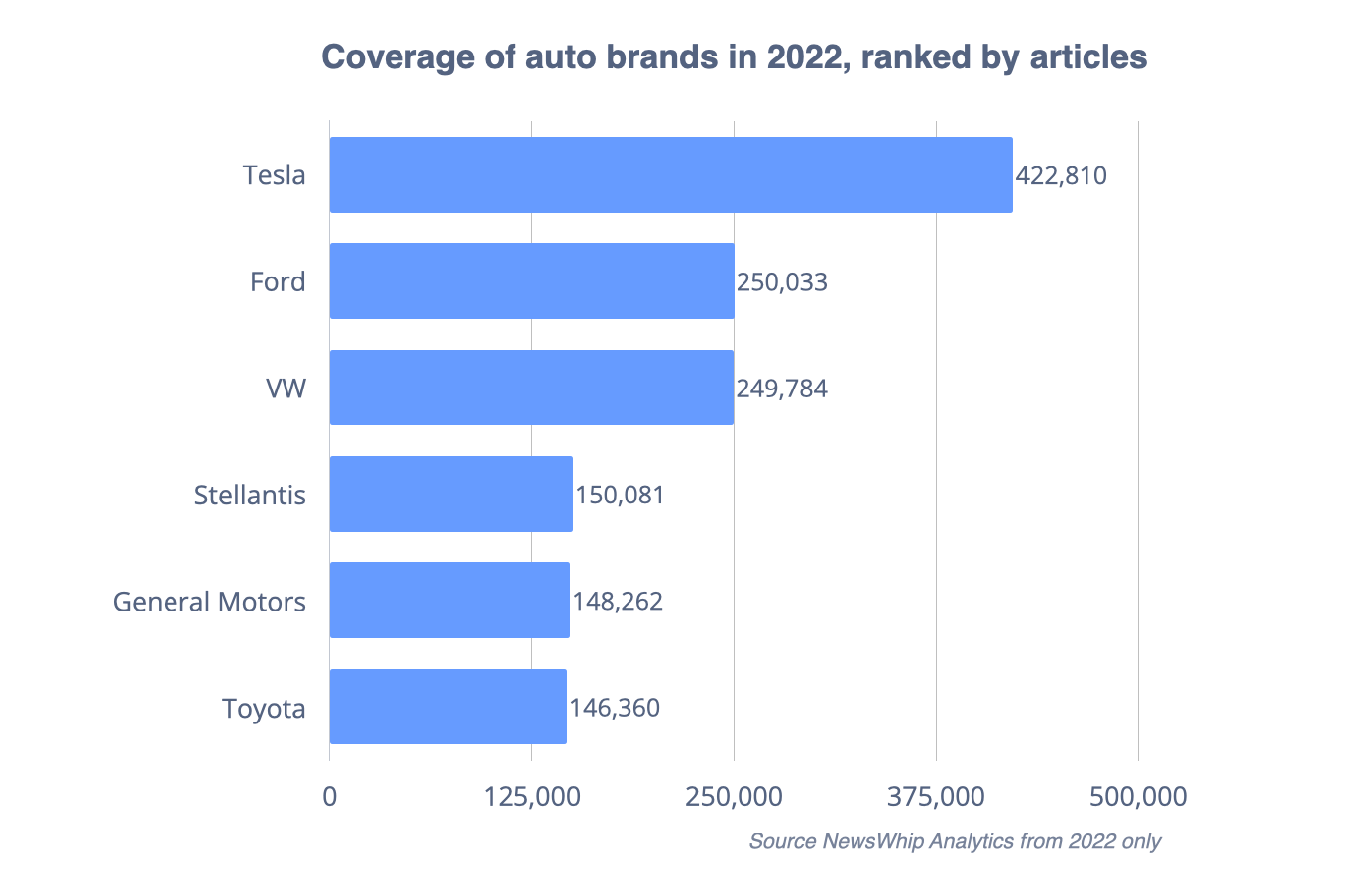

Tesla had a big year for coverage, but struggled to escape the shadow of its CEO, as Elon Musk weighed into a number of political conversations, and the brand saw itself inexorably tied to his comments even when they didn’t involve the electric car company at all.

Local stories amplified by brands’ actions continued to be a winner for car brands, with General Motors following in Ford’s footsteps in helping out after a natural disaster.

The media interest in car companies was much less varied by brand compared to other industries, with all of them getting similar levels of coverage, though Tesla did remain something of an outlier.

We learned a lot from our analysis of what happened in 2022, and there’s even more to discover in the report itself, which you can find here.